简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Beware of POSB Phishing Scams: $172,000 Lost! Protect Yourself Now

Abstract:Over $172,000 lost in POSB phishing scams since April. Learn how to protect yourself from banking fraud with these crucial safety tips.

Since April, phishing scams targeting POSB customers have led to at least $172,000 in losses. The police have received 13 reports related to these scams, where cybercriminals impersonate the bank to steal personal information.

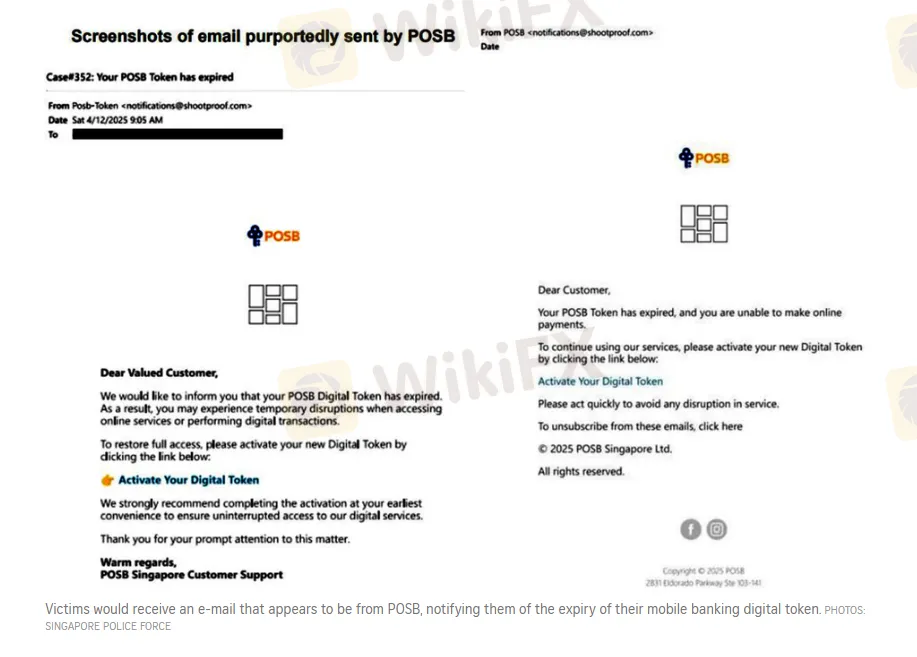

Victims receive an email that appears to be from POSB, claiming that their mobile banking digital token is about to expire. The email urges them to activate or update their token by clicking on a link provided in the message.

However, this link directs them to a fraudulent website designed to steal sensitive information. Once victims enter their banking credentials, card numbers, and one-time passwords, their accounts are compromised. Unauthorized transactions, often in foreign currencies, typically alert them to the scam.

On May 6, police issued a public warning, advising people to avoid clicking on links in suspicious emails, SMS messages, or communications from platforms like iMessage or Androids rich communication services, which claim to be from banks.

To prevent such attacks, customers are encouraged to set transaction limits on their internet banking and utilize features like Money Lock. Money Lock allows users to digitally secure their savings in an account from which no funds can be withdrawn, adding an extra layer of protection.

Singapore experienced a record $1.1 billion in scam losses in 2024, highlighting the growing threat of phishing fraud. Victims are urged to stay cautious and avoid interacting with unsolicited messages or clicking on unknown links.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fake Trader Faces 20 Years & RM9 Million Fine for RM1.45 Mil Derivatives Scam

A Malaysian man who posed as a ‘licensed’ futures trader has been handed a 20-year prison sentence and a RM9 million fine after admitting to running a fraudulent derivatives investment scam.

FBI Issues Urgent Warning on Crypto Recovery Scams

FBI warns crypto scam victims about fake law firms claiming to recover assets. Stay cautious to avoid further losses and protect your personal data from fraud.

WikiFX Community Event Series, “Thailand Elites’ View”

WikiFX launched the “Thailand Elites’ View” event in its official community, featuring heavyweight guests from the Elites Club who shared their insights on the current state of Thailand’s forex market, compliance trends, and the building of investor confidence.

Scam Alert: Know the Risky Side of InstaForex in India

you should always Scam Alert in forex market. If something seems too good to be true, it often hides red flags behind it. Therefore, We reviewed InstaForex and reveal hidden risks associated with it. Whether you are an Indian trader, a potential user, or an existing client, it is crucial to understand the risks associated with InstaForex .

WikiFX Broker

Latest News

Join WikiFX’s Agent Growth Event | Turn Your Success into a Global Achievement

Forex Trends Explained for Your Successful Trading Experience

Do Kwon Faces 130-Year Prison Sentence After Guilty Plea in $40B Crypto Collapse

Best 5 Low-Spread FX Brokers in India 2025

Major Pairs in Forex: Top Traded Currency Insights

What is ECN in Trading? A Simple Guide

SEC Settles California Trader with Over $234,000 Spoofing Scheme

What Is Forex Trading Fee? A Beginner’s Guide

Understanding UAE’s Financial Market Regulation: SCA and DFSA

Scam Alert: Know the Risky Side of InstaForex in India

Currency Calculator