简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Can cryptocurrencies be regarded as mortgage collateral?

Abstract:The U.S. Federal Housing Finance Agency (FHFA) has issued a directive to mortgage giants Fannie Mae and Freddie Mac to begin evaluating cryptocurrency holdings as part of mortgage risk assessment criteria.

The U.S. Federal Housing Finance Agency (FHFA) has issued a directive to mortgage giants Fannie Mae and Freddie Mac to begin evaluating cryptocurrency holdings as part of mortgage risk assessment criteria.

The move marks a potential turning point for crypto adoption in the U.S. housing market and reflects the federal governments evolving stance on digital assets.

A Boost for Crypto-Holding Borrowers

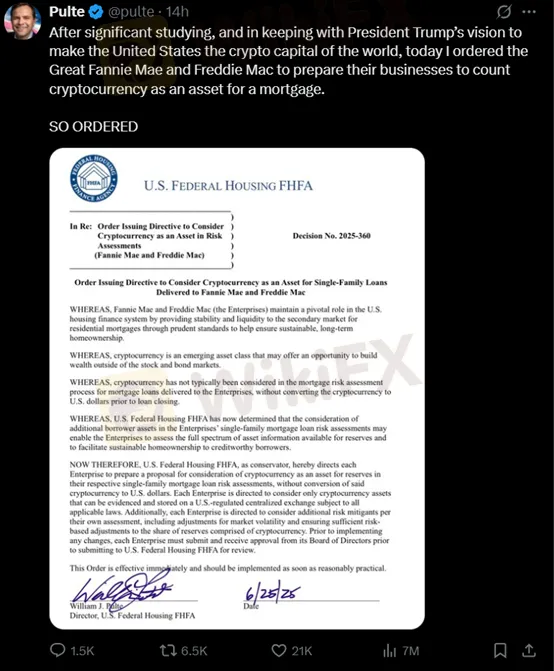

The directive, announced Wednesday by FHFA Director William Pulte via social media, signals an effort to make mortgage financing more accessible for homebuyers who hold digital assets.

“After extensive research and in line with President Trump‘s vision to make America the ’crypto capital of the world, I have directed Fannie Mae and Freddie Mac to prepare for the inclusion of cryptocurrency holdings as recognized assets in mortgage applications,” Pulte posted.

While some smaller lenders in the U.S. have previously accepted crypto as collateral, this is the first time a federal housing authority has formally acknowledged digital assets in mortgage underwriting standards.

The FHFA's move comes at a time when mortgage application volumes remain sluggish, weighed down by high interest rates and affordability challenges. By expanding the definition of eligible assets, the agency is not only increasing accessibility but also potentially stimulating loan activity in a stagnating housing market.

Analysts note that this change could unlock lending opportunities for a growing segment of digitally native borrowers who may not hold significant traditional assets but possess meaningful crypto wealth.

Unanswered Questions Remain

However, the directive stopped short of specifying which cryptocurrencies will be eligible for consideration. This lack of clarity raises questions around volatility, valuation methods, and regulatory consistency, particularly as crypto markets remain highly fluid and decentralized.

Industry experts stress the importance of clear guidelines to prevent abuse and ensure that lenders can accurately assess risk.

“This is a bold step, but the details will matter. Without standardized rules on acceptable coins, pricing models, and custody requirements, implementation will be complex,” said a senior analyst at a Washington-based financial policy think tank.

Aligning with the Trump Administration's Crypto Agenda

The FHFA‘s move aligns closely with the Trump administration’s broader agenda to promote cryptocurrency adoption across financial sectors. Since returning to the political spotlight, former President Trump has repeatedly voiced support for blockchain innovation and digital finance infrastructure in the U.S.

The decision also hints at a larger regulatory shift, where federal agencies may begin integrating crypto considerations into other forms of financial oversight and risk modeling.

Conclusion

By instructing Fannie Mae and Freddie Mac to prepare for crypto asset integration, the FHFA is signaling a historic shift in U.S. housing finance policy. While challenges around implementation, regulation, and market volatility remain, the move opens new doors for crypto-savvy homebuyers and brings the U.S. one step closer to mainstreaming digital assets.

As the details unfold, all eyes will be on how the mortgage industry responds — and whether the FHFAs bold step will usher in a new era of crypto-backed home ownership.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Investing in Coinexx? Think Again Before Your Account Balance Hits ZERO

Coinexx has emerged as a nightmare for traders who once saw potential and profit in its platform. The problems lie in its lack of transparency, which has left many investors with a ZERO balance. Scamming investors by employing fraudulent tactics and introducing bogus trading rules is increasingly becoming its status symbol. The endless negative reviews of this scam broker are trending on various platforms. To expose the troubling investor experiences, we’ve compiled sharp complaints from verified users of Coinexx. Read on!

UnityFXLive: How This Broker Scammed Over $350,000 ? Know the Red Flags

On August 4, 2025 Indian police arrested two men for running a fake forex trading scam under the name UnityFXLive.com. The suspects were caught operating from a rented office in Goregaon, Mumbai. During questioning, they revealed the name of a third person who is believed to be the mastermind behind the scam. He is currently on the run. The scammers promised people high returns on forex investments, but instead of doing real trading, they stole the money using fake online platforms.

FXPRIMUS Exposed: Withdrawal Denials, Account Blocks & Other Alarming Issues

Have your fund withdrawal applications been constantly denied by FXPRIMUS? Does the forex broker inappropriately block your trading account? Are your deposits disappearing without reaching your trading account? There’s something seriously wrong with this forex broker, whose track record keeps getting worse by the day. Many traders have expressed their anguish on several broker review platforms. While reading those reviews, we could not resist exposing this broker. Check out how traders have criticized FXPRIMUS for its illicit acts.

FXPRIMUS Exposed: Withdrawal Denials, Account Blocks & Other Alarming Issues

Have your fund withdrawal applications been constantly denied by FXPRIMUS? Does the forex broker inappropriately block your trading account? Are your deposits disappearing without reaching your trading account? There’s something seriously wrong with this forex broker, whose track record keeps getting worse by the day. Many traders have expressed their anguish on several broker review platforms. While reading those reviews, we could not resist exposing this broker. Check out how traders have criticized FXPRIMUS for its illicit acts.

WikiFX Broker

Latest News

Investment Scam Alert: FCA Identifies 15 Scam Brokers

Exploring Laxmii Forex: Kharadi's Financial Hub

BaFin Issues Consumer Alerts Against Unauthorised Platforms

Retired Man Loses Life Savings to ‘Sister Duo’ in Forex Scam

Telegram vs WhatsApp vs Discord: Which Platform Is Best for Forex Signals?

TradexMarkets: 5 Troubling Signs You Shouldn’t Ignore

A Guide to Buy Stop vs Buy Limit in Forex Trading

SEC Implements New Rules for Crypto-Asset Service Providers

Binance Users Convert Crypto and Withdraw Instantly to Mastercard

Forex Swaps Explained in 5 Minutes – Everything You Need to Know

Currency Calculator