简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Your Forex Strategy Failing? Here’s When to Change

Abstract:Have you been encountering frequent forex losses? Finding it hard to gain the trading momentum? Can’t understand whether your current forex strategy is in line with the shift in economic indicators or the geopolitical climate? Overcomoming these will require a change to your forex investment strategy. Learn those smart strategic changes here.

Have you been encountering frequent losses in forex trading? Finding it hard to gain the trading momentum? Can‘t understand whether your current forex strategy is in line with the shift in economic indicators or the geopolitical climate? Your concerns are genuine! Although losses can happen in forex trading due to adverse market conditions, excessive use of leverage, and other negative indicators, they have to stop eventually. This is where you must understand how to use forex calls better. This will require a calibrated change to your forex investment strategy. In this article, we will guide you on the times when you need to change your forex strategy. Let’s begin!

Times When You Need to Alter Your Forex Investment Strategy

When Losses Refuse to Stop

If you have been facing forex losses for a long time, start introspecting before you lose interest in this investment, which actually benefits investors over time. Consistent losses will likely be due to a flawed trading strategy. Poor risk management practices, erroneous market analytic tools, or bad trade executions are some strategic errors traders can commit. These errors prove costly with a mountain of losses.

Before it gets too late, start finding the exact reason for losses. If excessive leveraging contributes to losses, you need to reduce the position size in line with the account size. Or if you are struggling to estimate correct price movements, look for a change in the analytical tool. The tool you have may not have the right insights to make correct price-related decisions. A robust analytic tool will provide you with genuine insights to make accurate price estimations, helping you reverse the losses.

The Dramatic Shift in Market Conditions

Forex markets dont remain the same; they keep changing based on the changes in economic indicators, investor sentiment, and geopolitical scenarios. The changes in these can lead to a shift in the market dynamics. As a result, there can be variations in price trends, asset correlations, and volatility levels. You would wonder how to use forex strategies to align with changing market trends. This calls for adapting to the new market environment by adjusting your forex investment strategies. As the market continues to remain highly volatile, you need to implement multiple stop losses or change your position size relative to your trading account.

The Dynamic Regulatory Environment

Changes introduced by the market regulators significantly impact currency trading access, practices, and compliance norms. You need to stay updated with the changing regulatory requirements and figure out how they influence your forex trading activities. Regulatory changes may lead to restrictions in trading strategies such as high-frequency shorting or trading. They may even impose fresh compliance norms necessitating changes to risk management practices and operational procedures.

Do Emotions Dictate Your Currency Trading Activities? Start Making Practical Decisions

Forex trading can bring all sorts of emotions such as greed, impatience and fear. Making decisions based on these is a sure-shot loss-making proposition. For example, if price movements go as expected, you use massive leverage to take control of a wide market position. Suddenly, the market reverses and converts your gains into sharp losses, making you wonder what went wrong. Making changes to the position by keeping an eye on technical and economic indicators is pivotal to navigating a fluctuating forex market.

Wrapping Up

Forex investments are for long-termers, and changing strategies to align with evolving market needs will help you prevail for an extended period. With necessary modifications, you will be in control of how to use forex investments amid changing times.

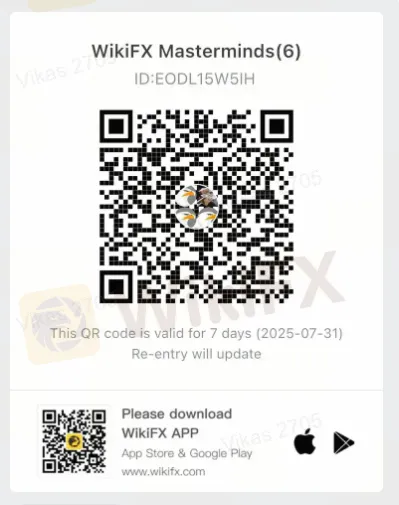

Join WikiFX Masterminds where you can learn groundbreaking forex trading strategies, the latest trends, and more. Scan this QR code to join our community.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

TradexMarkets: 5 Troubling Signs You Shouldn’t Ignore

Stop! Read this article if you're thinking about using TradexMarkets. There are several warning signs that suggest this broker may not be safe. Check out this article to find out why. Be safe.

Thinking of Investing in TD Ameritrade? Here’s What May Shock You

Experienced both highs and lows with TD Ameritrade in terms of trading experience and customer support? You’re not alone! From humble beginnings to losses and poor experiences, TD Ameritrade has turned out to be a shocking surprise for traders trusting it for wealth creation. The fraudulent broker has moved into the bad books of traders, quickly erasing pleasant memories they had at the beginning. Read on to learn more about it.

Bybit Scam Alert: What Every Trader Must Know!

The cryptocurrency trend is still growing and isn’t going away. More people are investing every day, hoping to profit from this fast-moving market. But opportunity comes with risk. If you want to start trading, make sure you choose a broker that is safe, licensed, and transparent. Remember, if you fall for the Scam brokers like Bybit, they could steal your money. Learn why Bybit is not a safe choice before you invest.

A Guide to Buy Stop vs Buy Limit in Forex Trading

Want to make a mark in forex trading by seizing hidden growth opportunities or preventing capital loss? Learn the art of locating orders. With an in-depth understanding of order functionality involving the impact on trades, traders can successfully navigate the forex market. As far as buying is concerned, traders need to acquaint themselves with a buy limit and a buy stop. These two orders play a critical role in helping traders enter and exit the market efficiently.

WikiFX Broker

Latest News

D. Boral Capital agrees to a fine as a settlement with FINRA

Beware of Fake RS Finance: How to Spot Scams

Fortune Wave Solution: SEC Warns of Investment Scam

XS.com Broker Partnership Expands Liquidity with Centroid Integration

FCA Publishes New Warning List! Check It Now to Stay Safe

EC Markets: A Closer Look at Its Licenses

Housewife Scammed of RM68,242 in Online Investment Scam

From Charts to Profits: Unleashing the Power of Forex Trading Tools

Is TD Ameritrade Safe? How to Spot Fake URLs and Stay Protected

Engineer Loses RM230,000 in “Elite Group” Investment Scam

Currency Calculator