简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Think Before You Trade: InstaForex and InstaTrade Flagged in Malaysia

Abstract:Malaysia’s financial regulator has issued a warning to investors regarding two trading platforms, namely InstaForex and InstaTrade.

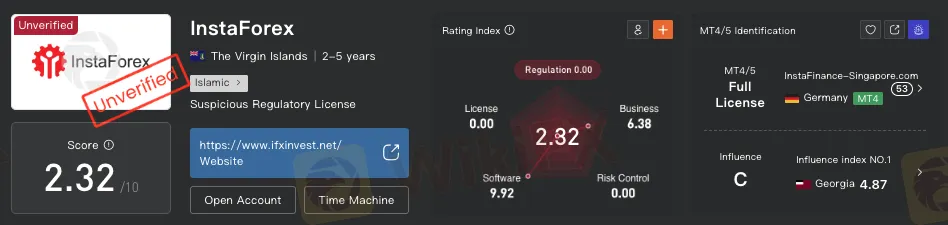

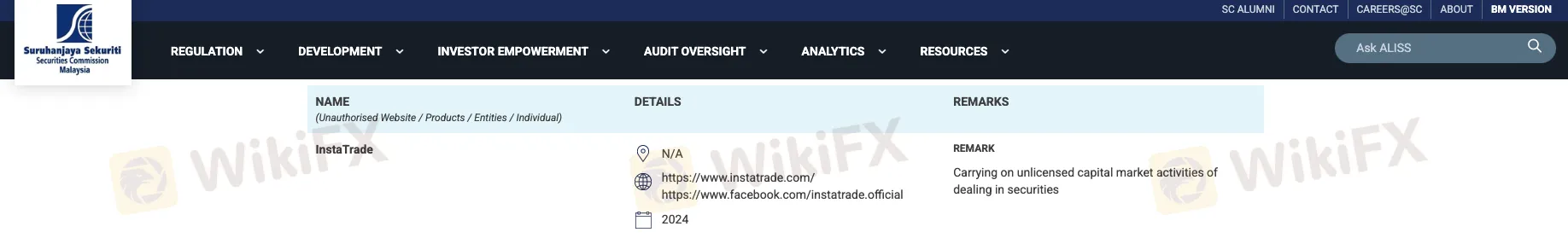

Malaysia‘s financial regulator has issued a warning to investors regarding two trading platforms, namely InstaForex and InstaTrade. Both brands, operating under the InstaFintech Group, have been added to the Securities Commission Malaysia’s (SC) investor alert list for conducting unlicensed capital market activities within the country.

According to the SC, InstaForex and InstaTrade have been offering securities-related services without the necessary regulatory approval, thereby breaching Malaysia‘s capital market laws. The regulator’s statement points to unauthorised dealings in securities as the reason for their inclusion on the warning list.

InstaForex, in particular, has gained significant recognition in the retail trading space, offering services in foreign exchange (forex) and contracts for difference (CFDs) across various global markets. InstaTrade, a lesser-known affiliate, operates under the same corporate umbrella. Despite their international visibility and expansive user base, the SCs move suggests that neither platform has met the licensing standards required to operate legally in Malaysia.

The investor alert list maintained by the SC serves as a protective measure to help the public identify entities that may pose a risk to their investments. By flagging InstaForex and InstaTrade, the commission aims to raise awareness and discourage Malaysian investors from engaging with platforms that fall outside of regulatory oversight.

This development follows a broader pattern where international trading firms, regardless of their global standing, face increased scrutiny when operating without local authorisation. The SC has previously issued similar warnings against other high-profile brokers, reinforcing its message that popularity does not equate to compliance.

Malaysias securities watchdog has made it clear that investor protection is a priority, and it encourages members of the public to conduct due diligence before committing funds to any online trading platform. The SC also provides dedicated channels for reporting suspicious or unlicensed financial activity, further underlining its proactive stance against unauthorised services.

For traders and investors in Malaysia, this warning serves as a critical reminder to verify the regulatory status of any broker, particularly those offering complex and high-risk products like forex and CFDs. While InstaForex and InstaTrade may appear credible on the surface, the SCs alert indicates that their operations do not meet the legal requirements set out under Malaysian law.

As the online trading industry continues to expand, regulators are stepping up efforts to ensure that platforms entering their markets adhere strictly to licensing rules, placing investor safety at the forefront.

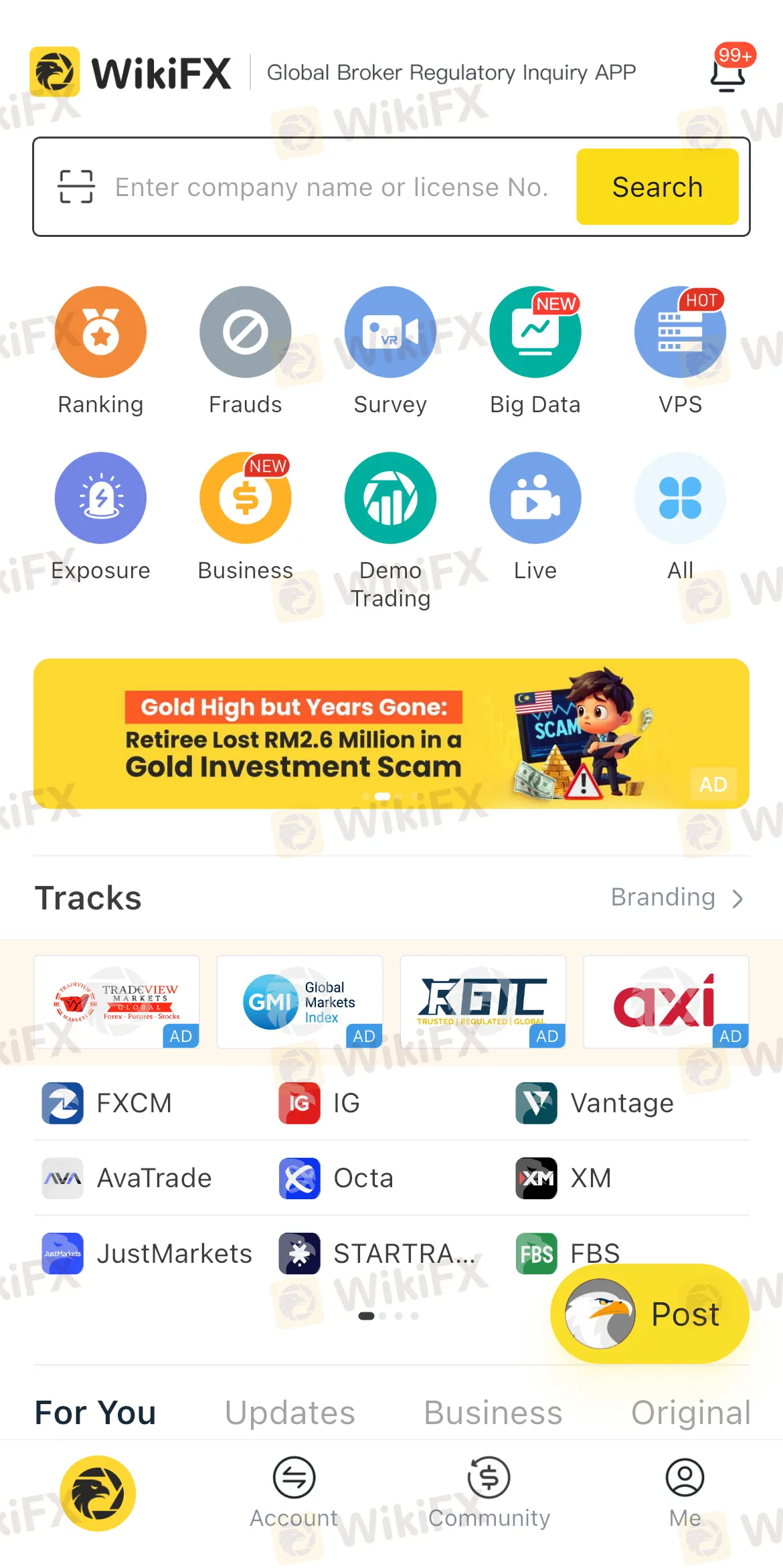

Traders and investors can also use a free mobile application called WikiFX, which plays a crucial role in verifying the legitimacy of brokers and financial platforms. WikiFX provides an extensive database of global broker profiles, regulatory status updates, and user reviews, enabling users to make informed decisions before committing to any financial investment. Its risk ratings and alerts for unlicensed or suspicious entities help investors identify red flags and avoid potential scams. By leveraging tools like WikiFX to research a brokers background, individuals can safeguard their savings and minimise the risk of falling victim to fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Plusonetrade Exposed: Promises High Returns, Delivers Only Trade Losses

Do you feel that Plusonetrade only makes you deposit with high-return promises? Does it deny withdrawals or allow you to take away just the principal amount? Have you been witnessing a lack of customer support to address your withdrawal queries at this forex broker? You have unfortunately trusted a fake broker that is operating without a valid license. The scams are obvious as traders are vehemently opposing the foul play committed by Plusonetrade on broker review platforms.

Avoid Losing Money: 6 Red Flags That Make LQH Markets Risky Choice

The only true way to protect your hard-earned money in the forex market is by staying informed and alert. With the growing number of fraudulent brokers, this dynamic and tempting market has become increasingly risky. Awareness is your best defense. This article serves as another important scam alert, to help you stay safe and avoid losing your money.

Most Volatile Currency Pairs You Should Know Before Trading

Do you think that trading in the most volatile currency pairs is a loss-making proposition? Maybe you are missing out on the profit waiting for you! Yes, you still need to be tactical and strategic when opening and closing positions. However, the increased possibility of dramatic price movements in currency pairs opens up avenues for higher profits while also exposing you to market risks. In this article, we will discuss the most volatile forex pairs worldwide. Read on!

Is Learning Forex Trading Online a Good Idea? Pros and Cons Explained

Forex trading is becoming more popular around the world. To help with this, many brokers are offering forex education courses. Some are free, and some are paid. Some brokers even have special academies to teach trading. This trend is growing fast, but the big question is: Is learning forex online really helpful? And what are the risks that you may not know about? I

WikiFX Broker

Latest News

D. Boral Capital agrees to a fine as a settlement with FINRA

Beware of Fake RS Finance: How to Spot Scams

Fortune Wave Solution: SEC Warns of Investment Scam

XS.com Broker Partnership Expands Liquidity with Centroid Integration

FCA Publishes New Warning List! Check It Now to Stay Safe

EC Markets: A Closer Look at Its Licenses

Housewife Scammed of RM68,242 in Online Investment Scam

From Charts to Profits: Unleashing the Power of Forex Trading Tools

Is TD Ameritrade Safe? How to Spot Fake URLs and Stay Protected

Engineer Loses RM230,000 in “Elite Group” Investment Scam

Currency Calculator