简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Nonfarm Payroll Data Falsified? Trump Fires Labor Secretary

Abstract:U.S. employment data serves as a key gauge of future consumer demand strength. The latest Nonfarm Payroll (NFP) report showed a mere 73,000 jobs added, sharply below the previous 140,000 increase and

U.S. employment data serves as a key gauge of future consumer demand strength. The latest Nonfarm Payroll (NFP) report showed a mere 73,000 jobs added, sharply below the previous 140,000 increase and market expectations. In addition, the prior months figure was drastically revised down from 147,000 to just 14,000. This triggered a surge in U.S. Treasury prices, sharp declines in equities, a steep drop in the U.S. Dollar Index, and simultaneous rallies in non-USD currencies and gold.

(Chart 1: Global Market Performance – Commodity prices reflect futures pricing; Source: MacroMicro)

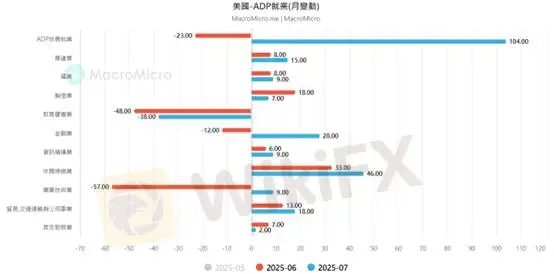

Given the controversy over the NFP figures, we compared them with private sector data from the ADP Employment Report.

In July, U.S. ADP private payrolls increased by 104,000. According to ADP Chief Economist Dr. Nela Richardson, job creation and wage growth data indicate a healthy U.S. economy. Employers remain confident in consumer spending resilience.

The ADP report showed wages for job stayers rose 4.4%, while job changers saw a 7% year-over-year increase. Over the past four months, wage growth has remained steady. By industry, wage growth was strongest in financial activities (+5.1% YoY) and weakest in professional and business services (+4.2% YoY).

In terms of job growth, only education and health services recorded a decline (-38,000 jobs). Leisure and hospitality led gains (+46,000 jobs), followed by financial activities (+28,000 jobs).

(Chart 2: U.S. Nonfarm Payrolls; Source: MacroMicro)

(Chart 3: U.S. ADP Payroll Data; Source: MacroMicro)

Comparing Charts 2 and 3 reveals significant discrepancies between the NFP and ADP data—particularly in sector performance. Leisure and hospitality, as well as education and healthcare, show completely opposite trends. We consider ADP data to be a more reliable reference in this case, as private-sector surveys typically align more closely with on-the-ground economic conditions.

Nobel laureate Paul Krugman noted that Bureau of Labor Statistics (BLS) data is typically regarded as the “gold standard” for economic indicators. However, this NFP credibility crisis could push private surveys into the mainstream as alternative benchmarks.

President Trump dismissed BLS Commissioner Erica McIntyre, pointing out she was appointed under a Democratic administration and alleging she “fabricated data” last year to boost Democratic presidential candidate Kamala Harris ahead of the election.

From our perspective, this single event presents a short-term contrarian trading opportunity. A solitary disputed dataset lacks forward-looking value, and market participants are likely to rely on other indicators as reference points.

Gold Technical Analysis

Gold staged a sharp rebound last Friday. Based on the previously drawn upward trendline, prices reversed lower in Asian trading after testing the resistance level. Using the Fibonacci retracement for support and resistance analysis, the key level to watch on the upside is $3,373. Failure to break above could present an opportunity to initiate short positions.

Currently, prices remain below the neutral Fibonacci zone‘s 50% resistance at $3,353. Conservative traders may adopt a daily candlestick strategy—if today’s close remains below $3,353, short positioning is warranted.

Stop-loss recommendation: $15

Support: $3,333 / $3,267

Resistance: $3,353 / $3,373

Risk Disclaimer: The above opinions, analysis, research, prices, or other information are provided as general market commentary and do not represent the platforms position. All readers should assume full responsibility for their own risk. Please trade with caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

D. Boral Capital agrees to a fine as a settlement with FINRA

Beware of Fake RS Finance: How to Spot Scams

Fortune Wave Solution: SEC Warns of Investment Scam

XS.com Broker Partnership Expands Liquidity with Centroid Integration

FCA Publishes New Warning List! Check It Now to Stay Safe

EC Markets: A Closer Look at Its Licenses

Housewife Scammed of RM68,242 in Online Investment Scam

From Charts to Profits: Unleashing the Power of Forex Trading Tools

Is TD Ameritrade Safe? How to Spot Fake URLs and Stay Protected

Engineer Loses RM230,000 in “Elite Group” Investment Scam

Currency Calculator